Summer of 2020, ongoing pandemic. I was looking to pick up a project for my portfolio. One topic that always intrigued me was personal finance. Something I always had no control over. This is my journey to make personal finance better easier.

How it started

In college, I had fixed pocket money. Though I was able to manage my expenses until the end of the month, I had only found a good equilibrium with the expenditures I had and the allowances my parents were willing to give me. I did not know where the money was going, where I was spending it. So, I started by finding how others manage money. But no one around me had any clue, everyone had a similar plan. They knew their allowance and knew how to manage it until the end of the month, with a few hiccups of course.

😭

Solving the money problem

I wanted to learn about personal finances. In the process, create a digital product which could potentially help user like me, being introduced to money for the first time. Make sense of it. So, of course, I went to the internet to look. Believe me, there are a lot of products solving the problem with unique methodologies. For example, Cleo using conversational AI to completely change how we perceive money management, and a dozen other amazing bank-app integrated solutions such as Zero . But these were technological hurdles of building a fin-tech product. Instead, I tried understanding the psychology behind why so many people do not put in the effort to manage their money. To do that, I picked up a couple of books and tried managing (understanding and recording where I spend) my money.

The habit of managing your money

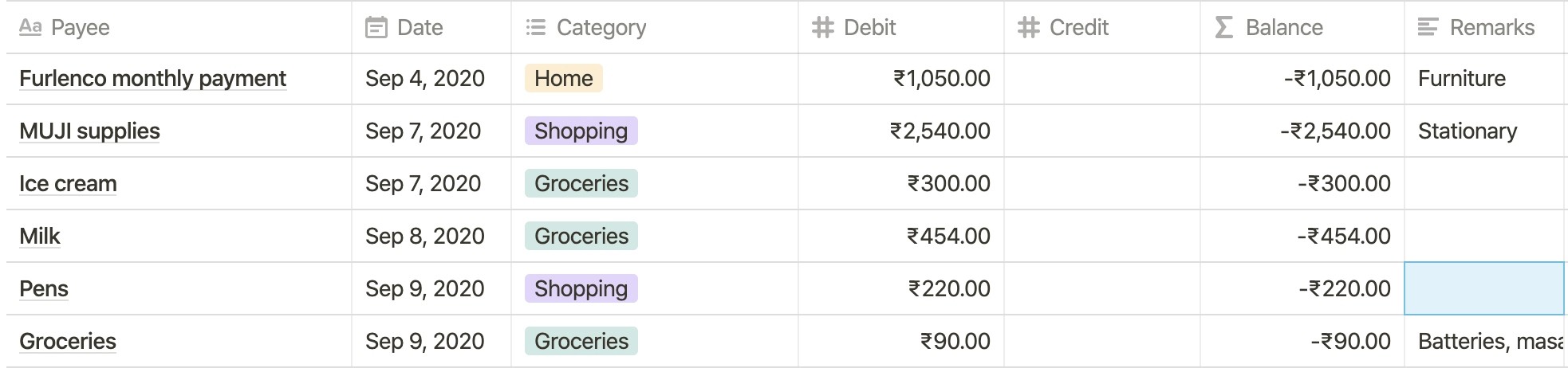

To get a better understanding, I started bookkeeping my spendings. Traditionally you record your transactions in a finance book or a spreadsheet. I prefer using a Notion table due to its ability to visualize data, apply filters and create logics(easily). This table along with a Shortcut on my phone home screen acted as my makeshift application to record my spending.

my makeshift finance app

Logging every transaction for the day is a drag. At first I was wondering if I can build my product around this habit formation. About a month of logging my transactions, I noticed a peculiar habit. I was checking in my phone's bank messages at night for all the unlogged transactions for the day. If I crosscheck my bank messages almost every night, why not build an experience around an automated version of that?

Designing the product

With this simple material (the User-card), we set out to design the space for remote teams to socialise together. Starting with something as simple as the color of our walls was contemplated. Walls aren’t pure-white in real life.

Conclusion

This design project spanned across 2 months, but the foundational layer of personal finance was laid out 4 years ago when I had to manage money for the first time. The main idea of this application is not to give you a specific budget, it does not tell you how to magically save money. But it enables you to do all this by letting you know where your money is going. With zero efforts, almost.